Our History

Building Futures Since 1915

Our legacy is rooted in trust, shared values, and a steadfast commitment to our clients and their communities.

Our founding values have withstood the test of time

Through wars, economic upheavals, financial crises, and generations of innovation, we’ve remained a trusted stalwart in the investment community.

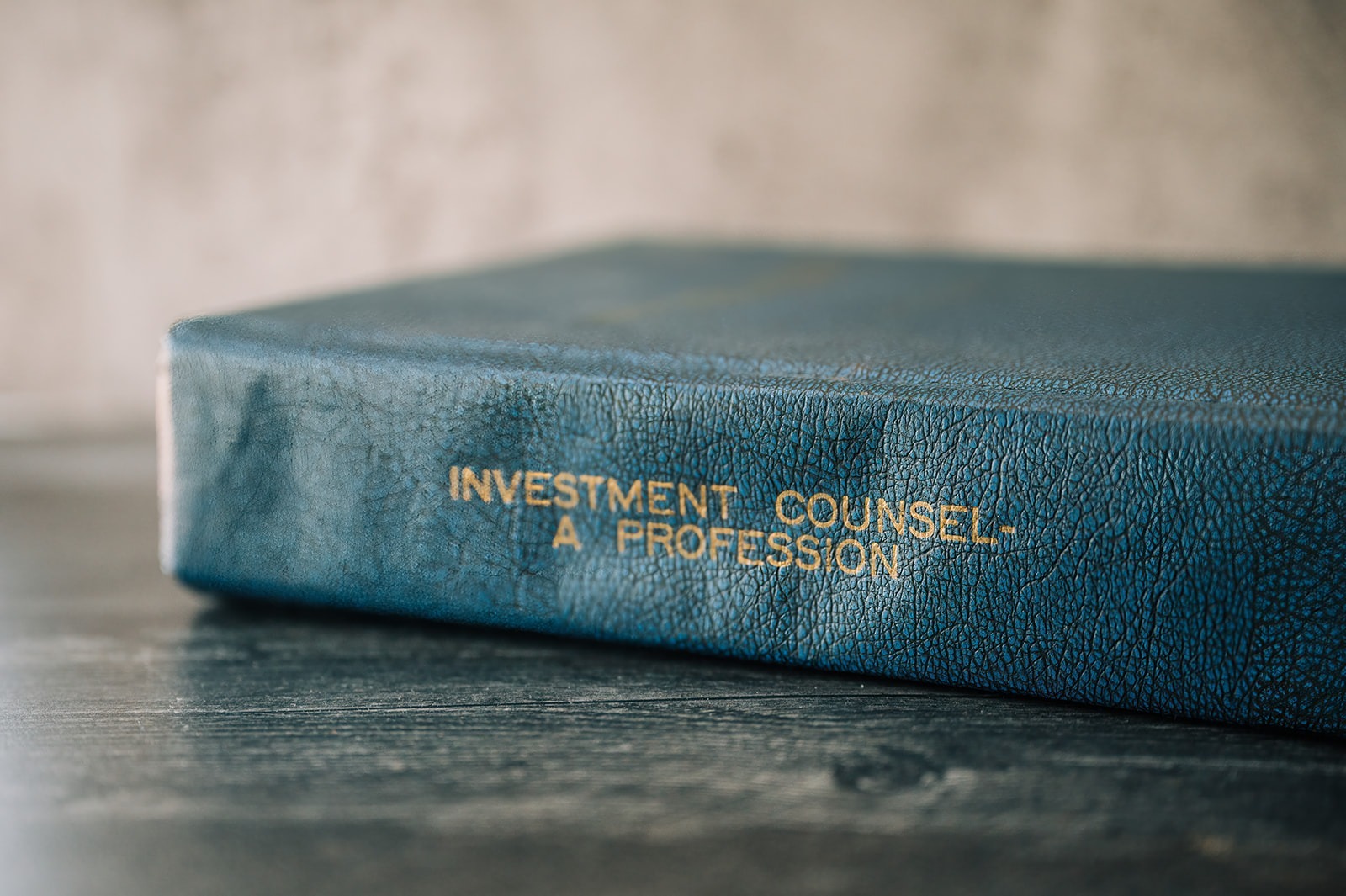

A.M. Clifford opens a brokerage in Los Angeles

1911

1915

Founds his investment counselor business

Focusing on independent advice, his firm is the first of its kind.

1915

1921

1925

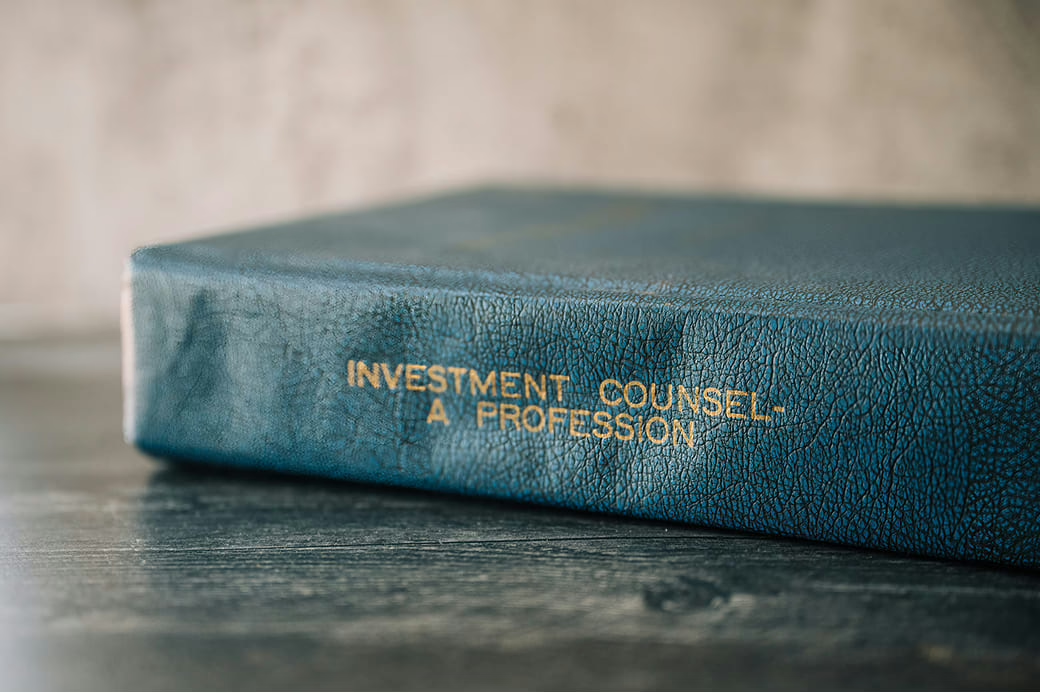

Clifford publishes The Investment Counselor

The principles that come to be adopted by the industry are first set out in this slim volume.

1925

1929

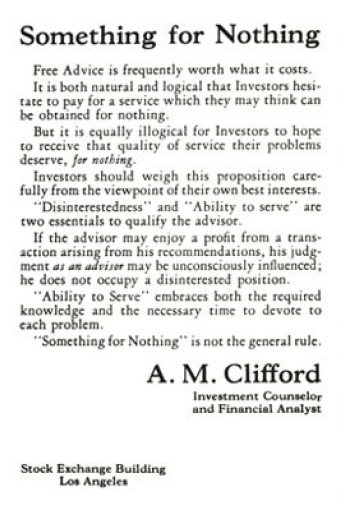

Clifford warns of a market crash

In the September 1929 edition of the Atlantic Monthly, A.M. Clifford observes, “History appears to be repeating itself. And so the pendulum swings, now this way, now that, and usually too far at its extremes.”

1929

1929

1937

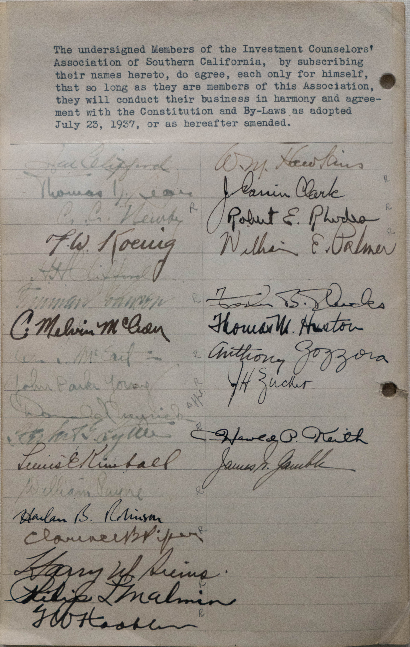

Founding of The Investment Counselors Association of Southern California

Clifford’s vision gains traction, as he and his contemporaries form one of the first professional associations for investment counselors.

1937

1941

1947

Founding of The Investment Counsel Association of America

Expanding beyond California, a national organization follows and survives to this day as the Investment Adviser Association.

1947

1949

Henry H. Clifford becomes a partner

The second generation of the Clifford family enters the investment counseling business.

1949

1962

1968

A.M. “Tony” Clifford II joins the firm

He becomes the third generation of his family to enter the investment counseling business.

1968

1984

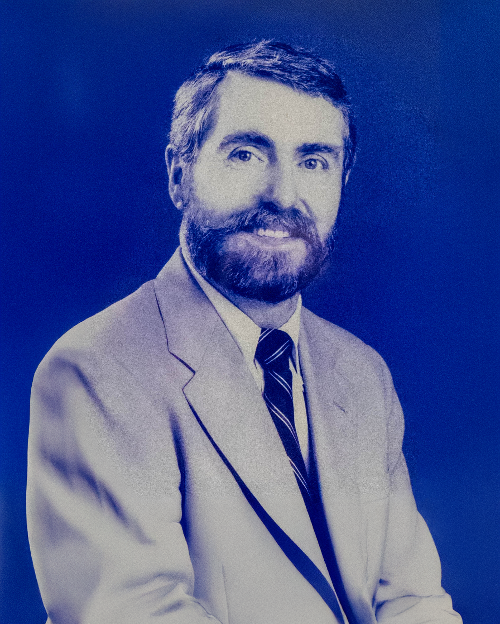

Philip V. Swan founds his own advisory

This former Clifford employee strikes out on his own.

1984

1987

1995

2000

2007

Clifford Associates and Philip V. Swan merge to become Clifford Swan Investment Counsel

2007

2007

2015

The firm celebrates its 100th anniversary, a new location, and independent ownership

2015

2020

2022

Clifford Swan introduces a new look

The firm refreshes its visual identity to support the client experience.