Understanding the One Big Beautiful Bill Act: Key Tax Changes

On July 4, 2025, President Trump signed into law H.R.1, commonly known as the “One Big Beautiful Bill Act” (OBBBA). This sweeping legislation addressed the scheduled expiration of tax provisions from the 2017 Tax Cuts and Jobs Act (TCJA) while introducing new tax measures and tweaking existing rules. Here’s what you need to know.

Income Tax Brackets Stay the Same

The seven ordinary income marginal tax brackets established in 2017 by the TCJA—10%, 12%, 22%, 24%, 32%, 35%, and 37%—are now permanent. The income thresholds for each tax bracket will continue adjusting annually for inflation. Starting in 2026, the thresholds for the 10% and 12% brackets will get an extra year of inflation adjustment.

Takeaway: More income will be taxed at the two lowest rates. The IRS will release the 2026 tax inflation adjustments later this year, but we expect the savings to be minimal.

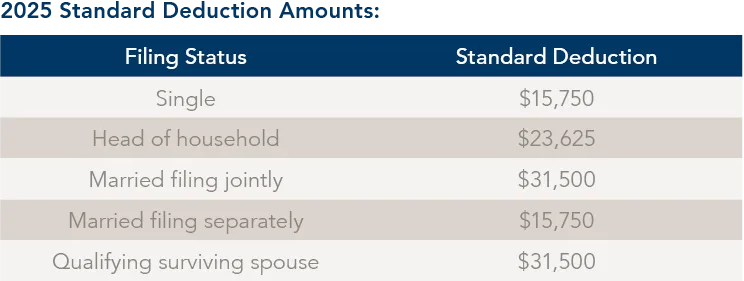

Higher Standard Deduction

Starting with the current 2025 tax year, the higher standard deduction amounts from the TCJA increase permanently and will adjust for inflation each year.

Takeaway: The standard deduction was already high, so this further raises the hurdle rate for itemizing deductions over taking the standard deduction. Consider “bunching” itemized deductions such as charitable contributions into alternating years to maximize tax savings.

“The standard deduction was already high, so this further raises the hurdle rate for itemizing deductions over taking the standard deduction.”

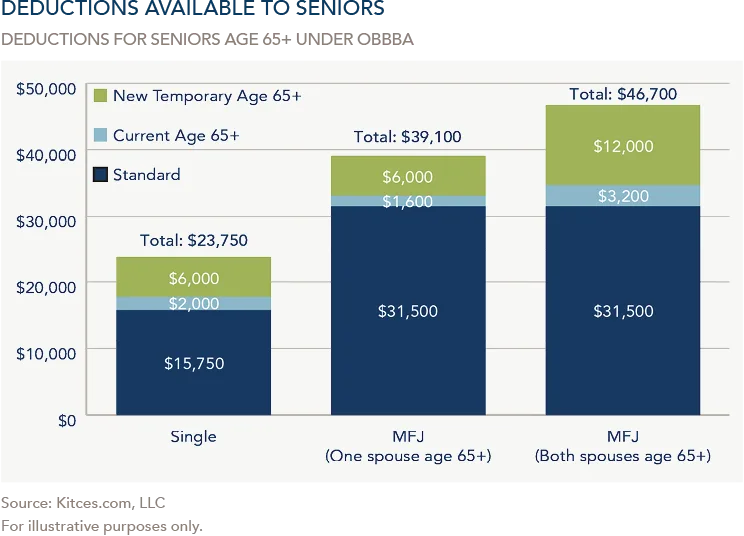

Enhanced Senior Deduction

From 2025 through 2028, taxpayers age 65 and older can claim an additional deduction—whether they claim the standard deduction or itemize—of $6,000 (single) or $12,000 (married filing jointly). This benefit phases out based on modified adjusted gross income (MAGI):

- Income Phase-Out Ranges:

- Married filing jointly: $150,000 to $250,000

- All other filers: $75,000 to $175,000

This new deduction is in addition to both the standard deduction mentioned previously and the existing senior deduction ($2,000 for single filers and $1,600 per spouse for married couples filing jointly). The graph below shows the potential total deductions for different filing categories.

Important note: This new deduction reduces taxable income for seniors, therefore reducing taxes owed. Despite early interpretations of the bill suggesting otherwise, normal Social Security taxation rules still apply.

Takeaway: Seniors should not assume Social Security is suddenly tax-free and then attempt to recognize more income. Have a discussion with your Investment Counselor and tax advisor to understand how this affects your overall tax situation.

SALT Deduction Increase

The cap on state and local taxes (SALT) deductions increases from $10,000 to $40,000 for most filers (married filing separately: $20,000) beginning this 2025 tax year. This limit will increase by 1% annually through 2029, then revert to $10,000 in 2030.

The deduction phases out for high earners exceeding the following modified adjusted gross income levels:

- Married filing separately: MAGI of $250,000

- All other filers: $500,000

For those with pass-through entities, such as partnerships and S-Corporations, the OBBBA preserves the pass-through entity tax (PTET) deduction, allowing these businesses to pay state tax at the entity level—a fully deductible business expense—instead of at the individual taxpayer level, making it subject to the SALT deduction cap.

“Consider ‘bunching’ deductions in 2025, 2027, and 2029 to maximize this temporary benefit before it expires in 2030.”

Takeaway: Households in these phase-out ranges should be cognizant of how recognizing additional income and capital gains affects their SALT deduction. There will be a certain point where taking the standard deduction becomes more optimal as the SALT deduction decreases. Consider “bunching” deductions in 2025, 2027, and 2029 to maximize this temporary benefit before it expires in 2030. Households may also consider deferring income to later years or accelerating deductions to reduce MAGI.

Charitable Deduction Changes

Starting in 2026, cash donations to public charities are now permanently deductible up to 60% of adjusted gross income (AGI). There’s also a new 0.5% floor on charitable contribution deductions, meaning households can only deduct charitable gifts that exceed 0.5% of AGI.

Beginning in 2026, those who take the standard deduction can also take a separate charitable contribution deduction, $1,000 for single filers and $2,000 for married couples filing jointly.

Takeaway: Itemizers should consider front loading their charitable contributions in 2025 to avoid the 0.5% floor next year. In 2026, those who take the standard deduction should keep records of their donations to claim the new $1k/$2k charitable contribution deduction.

Itemized Deduction Limit for High Earners

Beginning in 2026, taxpayers in the highest tax bracket (37%) will see their itemized deductions capped at 35 cents per dollar of income, reducing the tax benefit from 37% to 35%. In other words, the maximum tax savings from itemized deductions will be 35%.

Takeaway: Taxpayers in this top bracket may consider bunching deductions into 2025 to capture the full 37% tax benefit. This includes accelerating charitable contributions in 2025 to avoid the 0.5% floor mentioned earlier.

Qualified Business Income Deduction Made Permanent

Originally set to expire, the 20% deduction for qualified business income (QBI) is now permanent. The income phase-in thresholds have also been expanded:

- Single filers: $50,000 to $75,000 (indexed for inflation)

- Married filing jointly: $100,000 to $150,000 (indexed for inflation)

- Minimum $400 deduction if there is at least $1,000 in qualified income

Takeaway: More business owners may now qualify for this deduction. Work with your Investment Counselor and tax advisor to manage your income to stay within these expanded ranges.

Alternative Minimum Tax Changes

The alternative minimum tax (AMT) exemption amounts are now permanent. For 2025 these are:

- Married filing jointly: $137,000

- Married filing separately: $68,500

- All other filers: $88,100

- Trusts and estates: $30,700

Starting in 2026, the income threshold for the phase-out starts earlier at $1 million for married couples filing jointly and $500,000 for married couples filing separately, extended for inflation. Additionally, for those who exceed these thresholds, the phase-out exemption increases from 25% to 50%. The SALT deduction will also be added back to taxable income for the AMT.

Takeaway: These changes mean the phaseout will happen more rapidly, causing more households to be subject to the AMT. High earners may consider accelerating AMT-related items in 2025.

Estate Tax Exemption Increases

The estate tax exemption for 2025 is $13.99 million per person, or $27.98 million per couple. This amount was set to sunset at the end of the year, reverting to $5 million per person (adjusted for inflation) in 2026. However, the OBBBA raised the exemption to $15 million per person ($30 million per couple), made it permanent, and ensured it will be adjusted for inflation going forward.

“These changes mean the phaseout will happen more rapidly, causing more households to be subject to the alternative minimum tax.”

Takeaway: Please have your Investment Counselor and your attorney periodically review your estate plan documents to confirm they still reflect your wishes and needs. If you do not currently have estate plan documents in place, we encourage you to contact your Investment Counselor.

Expanded 529 Plan Uses

Starting July 5, 2025, funds from 529 savings plans can be used tax-free for more K-12 expenses (beyond tuition), including curriculum materials, books and other instructional items, online educational content, and exam fees. The annual limit for K-12 expenses increases from $10,000 to $20,000 in 2026.

Important Note: State tax treatment may differ for these withdrawals. Some states, like California, do not conform to federal law and impose state income tax and a 2.5% penalty on the earnings portion of 529 distributions used for K-12 tuition.

New Auto Loan Interest Deduction

For auto loans taken after December 31, 2024, interest is deductible up to $10,000 annually through 2028, subject to income phaseouts and the following requirements:

- The vehicle is for personal use

- It’s new (not pre-owned)

- It’s assembled in the United States

The Bottom Line

The One Big Beautiful Bill Act creates both opportunities and challenges. We’ll continue monitoring IRS guidance as more details emerge. Our wealth management approach combines investment management, tax planning, and estate strategies into comprehensive financial plans. Your Investment Counselor can work with your tax advisor and attorneys to develop strategies tailored to your specific situation.

The information presented in this article is based on our best understanding of the provisions found in H.R.1. These interpretations may change over time with additional information and further guidance from the IRS. Tax law affects everyone differently. Clifford Swan Investment Counselors are not tax advisors. We suggest you consult your tax advisor to understand how these changes impact your personal financial situation.

The above information is for educational purposes and should not be considered a recommendation or investment advice. Investing in securities can result in loss of capital. Past performance is no guarantee of future performance.