From Diploma to Dollars: Rules for Financial Success After College

Congratulations, you did it! Graduation is a major milestone, and with your diploma in hand a new chapter begins. What’s next? Whether you’re starting a job or exploring your next steps, one thing is certain: this is the perfect moment to take control of your financial future.

The habits you form now will shape your long-term financial success. Just like staying physically fit takes consistent effort, building wealth starts with good financial practices.

“The habits you form now will shape your long-term financial success.”

Here are four simple but effective principles to help you get started:

- Start Saving Early

- Be Disciplined

- Be Diversified

- Stay Patient

These habits may seem small now, but they’ll lay a strong foundation, setting you up for future financial freedom. Let’s take a closer look at what each one means, and how to make them part of your post-grad routine.

Start Saving Early

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

Often attributed to Albert Einstein, though unverified, this popular quote underscores the power of compound interest. This concept is critical in finance. Compound interest occurs when interest is earned (or charged) on both the original principal and accumulated interest, leading to exponential growth over time. This mechanism grows wealth for long-term investors and burdens borrowers with increasing debt.

“The main benefit of starting to save early is that it gives investments more time to grow and compound.”

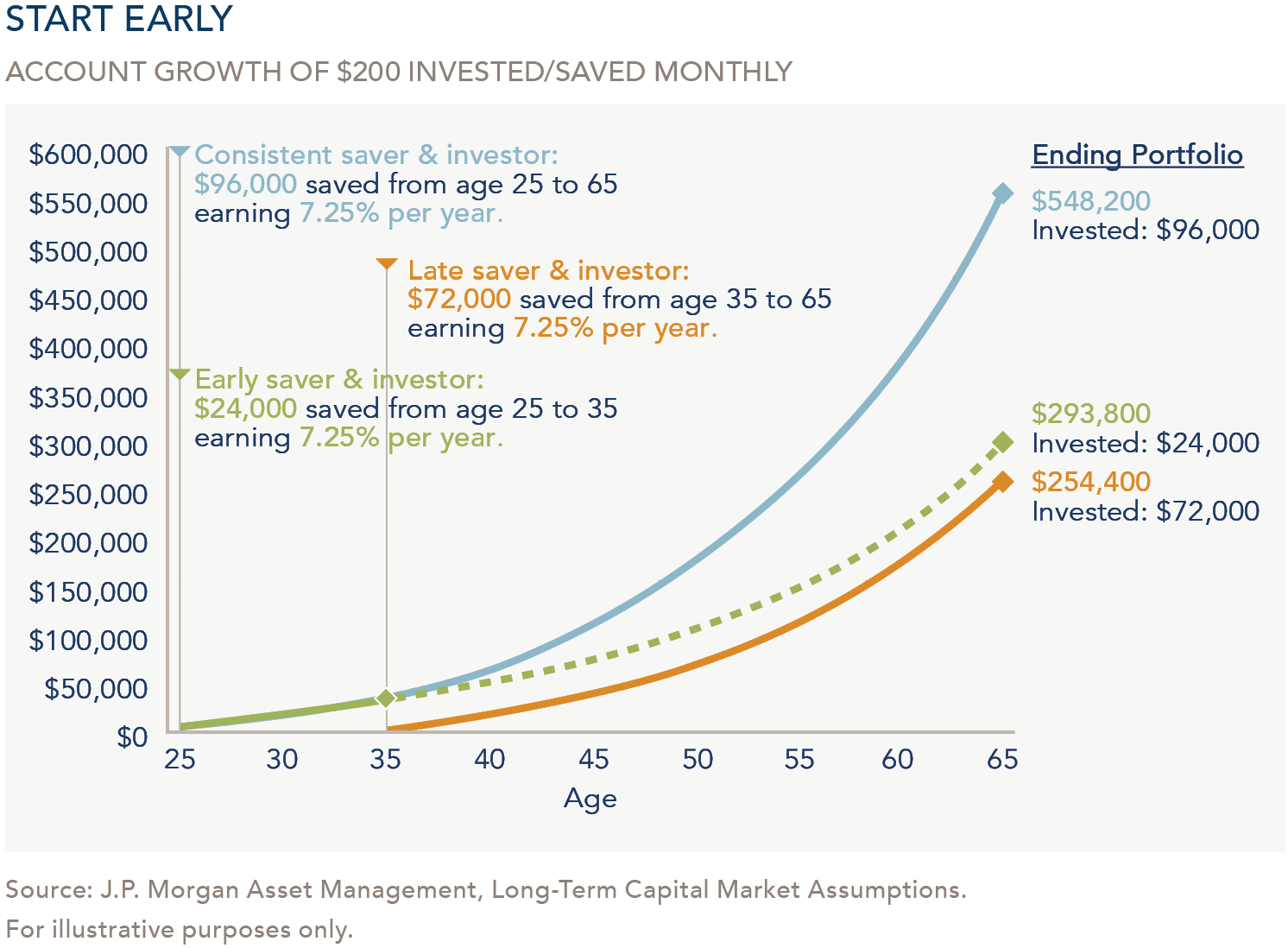

The main benefit of starting to save early is that it gives investments more time to grow and compound. The longer the time period, the better the potential returns.

Additionally, starting early and consistently investing relatively small amounts over a long period of time can take advantage of dollar-cost averaging, helping smooth out market ups and downs, as opposed to waiting to invest a larger lump sum later in life.

“…even if life circumstances (e.g., mortgage, childcare, tuition) limit your ability to continue saving, you can get ahead by starting early.”

The chart below demonstrates better return outcomes for those who start saving earlier than for those who start later. The blue line represents an investor beginning at age 25 and the orange line an investor who waited 10 years until age 35 to begin investing. The result is the blue-line investor ending with a portfolio over double that of the orange! As the dashed green line shows, even if life circumstances (e.g., mortgage, childcare, tuition) limit your ability to continue saving, you can get ahead by starting early.

Be Disciplined

Exercise discipline by creating a budget—and sticking to it. A good rule of thumb is to implement a 50/30/20 budget that allocates 50% to needs, 30% to wants, and 20% to savings.

Distinguishing between needs and wants can be nuanced. Sticking to a budget takes restraint and, at times, sacrificing instant gratification. The Marshmallow Test, developed in a 1970 study on delayed gratification by psychologist Walter Mischel, is a classic example. In the study, children were offered the choice between one small, immediate reward or two small rewards if they waited 15 minutes. Researchers found that the children who were able to wait longer for the two rewards tended to have better life outcomes, as measured by SAT scores, educational attainment, and other life measures.

Being able to exercise self-control can be beneficial to living a healthy financial life. A modicum of near-term discipline will help establish long-term financial flexibility.

While initiating savings within a budget is an admirable goal, it may be equally important to prioritize paying down debt (e.g., student loans, credit card balances) and establishing an emergency reserve covering 3 to 6 months’ worth of essential expenses.

Be Diversified

Don’t put all your eggs in one basket. Diversification of investment assets can be helpful over the long term by reducing the risk in your portfolio. Individual asset classes move up and down in different amounts at different times, sometimes in the same direction and sometimes not.

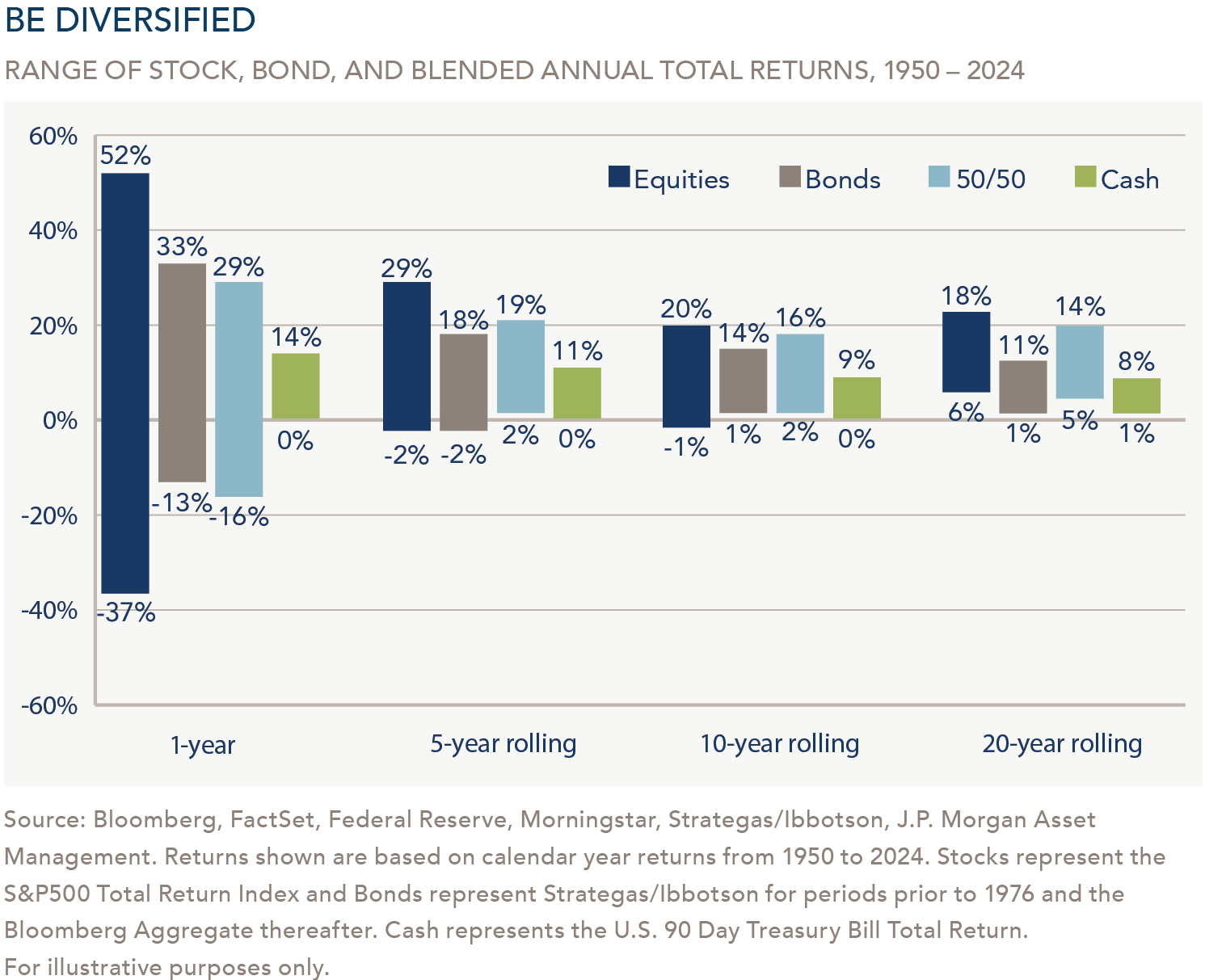

At a very basic level, you can allocate your investments among stocks, bonds, or cash. Your preliminary goal is to maintain the purchasing power of your assets. Leaving everything in cash likely won’t achieve this. You will need a mix of investments in equities (stocks) and fixed income (bonds) to keep up with inflation.

“You will need a mix of investments in equities (stocks) and fixed income (bonds) to keep up with inflation.”

You can invest in individual securities or a “basket” of securities via a mutual fund or ETF. Stocks and equity mutual funds represent ownership in publicly held companies. Their anticipated growth primarily comes from both price appreciation and dividends. While stocks generally provide the highest long-term returns among these asset classes, they also come with a higher degree of short-term up and down movement (volatility) due to a wide range of potential outcomes.

Bonds represent loans to publicly held companies or governments, and as a bondholder, you receive steady interest income during the holding period. While investing in bonds or bond mutual funds may not result in as high a long-term return as stocks, the range of outcomes is narrower, and the income tends to be more stable.

Diversifying across asset classes helps balance these differences over time. The chart below compares the ranges of returns of four separate portfolios over different time periods: 100% equities, 100% bonds, 50% equities/50% bonds, and 100% cash. As you can see, diversification lessens the volatility (shorter light blue bars vs. longer navy bars). Additionally, the ranges of outcomes compress over time (e.g., 1-year vs. 20-year) showing that, if you start early, the benefits of diversification can really have an opportunity to play out.

Over time, market fluctuations will cause your asset classes to drift from their original allocation targets. Taking a disciplined approach to rebalancing back to your original allocation may be in order. More importantly, life changes (marriage, family, retirement, death, etc.) should prompt revisiting your asset allocation. We believe that it is essential to craft a mix of investments that reflects your unique financial situation—and to update the makeup of your investment portfolio as your individual circumstances dictate.

Stay Patient

Add to your savings and investments when and if you are able. Adopt the mindset of leaving them invested for the long term. If saving and investing are already part of your budget, be patient when reviewing short-term outcomes. Remind yourself that you are in it for the long haul.

“…be patient when reviewing short-term outcomes.”

Don’t panic at the slightest downturn nor try to time the market. Just missing a few of the best days can significantly sideline your long-term return.

Remember the sage advice of renowned investor Warren Buffett and “be fearful when others are greedy, and greedy when others are fearful.” This will often mean being contrarian to what others are doing and not blindly following the herd mentality.

There are real benefits to staying patient with your savings and investments over time. The Rule of 72 is a simple way to estimate how long it will take for the value of your investments to double. Simply divide 72 by the annual rate of return. For example, with a 6% annual rate of return, it would take approximately 12 years to double your investment (72 ÷ 6 = 12).

Following these simple tips will help you lay a solid foundation for a secure financial future.

The above information is for educational purposes and should not be considered a recommendation or investment advice. Investing in securities can result in loss of capital. Past performance is no guarantee of future performance.